The biggest misconception in the insurance today for homeowners and businessowners is regarding damage. What is it, and does MINE qualify?

If you answered YES to each of those questions, you probably qualify

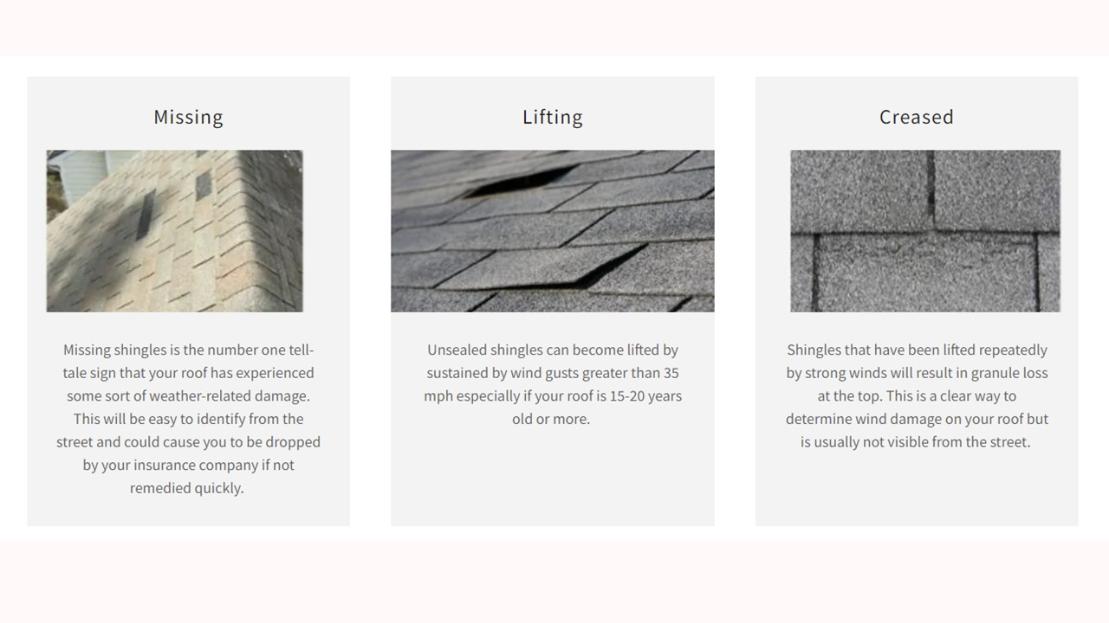

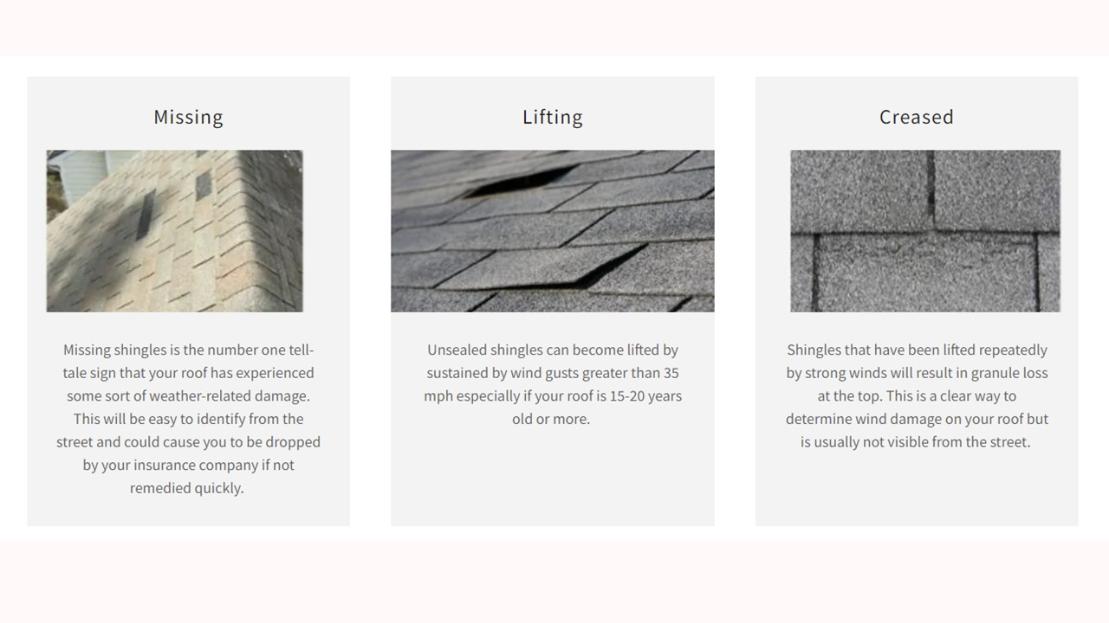

The above pictures, courtesy of www.knowyourinsurance.org, are some common examples of what #3 looks like in regards to Roofing Damage

If your siding needs a tarp or needs to be nailed back in, there is damage there

If a pipe bursts, sink or toilet overflows, or sump pump backs up - are you covered? MAYBE. But in most policies, even if the pipe, AC unit, or toilet isn't covered, all the other damage caused by the water can be, which is where the bulk of the cost is.

Other Examples of Damages Likely Covered by Insurance

All of these above incidents were SUDDEN, ACCIDENTAL, and CAUSED LOSS

Note - a deliberate or intentional act to cause damage is either vandalism (performed by someone against you/family member) or fraud (performed by you/family member)

If anything like the above has happened to you, or you have questions, CLICK HERE to get in touch with Brett ASAP

© Copyright Creationsglory